Perpetual and ETF/Leveraged trading are very risky and are not recommended for non-professionals. It is impossible to predict what Equilibrium will be worth in five years. Therefore, it is impossible to accurately predict the price of Equilibrium 5 years from now.

- Please also note that data relating to the above-mentioned cryptocurrency presented here (such as its current live price) are based on third party sources.

- Links provided to third-party sites are also not under MEXC’s control.

- The Equilibrium Games price page is just one in Crypto.com Price Index that features price history, price ticker, market cap, and live charts for the top cryptocurrencies.

- It utilizes a basket of fiat-pegged stablecoins, algorithmically stabilized by its reserve currency EQ, to facilitate programmable payments and open financial infrastructure development.

Equilibrium is a one-stop DeFi platform on Polkadot that allows for high leverage in trading and borrowing digital assets. It combines a full-fledged money market with an orderbook-based DEX. EQ is the native utility token that is used for communal governance of Equilibrium. Equilibrium is a one-stop DeFi platform on Polkadot that allows for high leverage in trading and borrowing digital assets.

Live Coin Watch

They are presented to you on an “as is” basis and for informational purposes only, without representation or warranty of any kind. Links provided to third-party sites are also not under MEXC’s control. MEXC is not responsible for the reliability and accuracy of such third-party sites and their contents.

It combines a full-fledged money market with an order book-based DEX. EQ is the native utility token that is used for communal governance of Equilibrium. XDOT is a liquid and tradeable wrapped DOT that unlocks liquidity of DOT locked in parachain auctions and delivers multiple crowdloan bonuses on Polkadot. Cryptocurrency prices are subject to high market risks and price volatility. You should invest in projects and products that you are familiar with and where you understand the risks involved. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

Equilibrium (EQ)Coin listings at exchanges

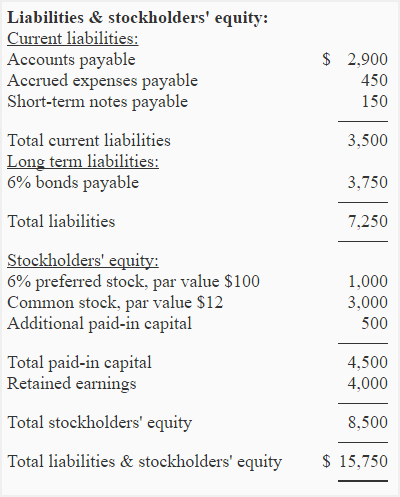

The table above shows the number of days which Equilibrium closed above a certain price level. Equilibrium price in US Dollar has decreased ndau price chart by -20.00% in the last 1 month. EQ is down -18.41% against Ethereum and down -16.39% against Bitcoin in the last 1 month.

That’s approximately 43.32% of Equilibrium current Market Cap. Futures contracts are legal agreements to buy or sell at a future date. Futures is a contract representation of Coins, and the actual settlement of (or cash) will happen in the future – when the contract is exercised. Attractive yield staking even for assets you thought deadweight. Fully on-chain orderbook to go long or short with up to 20x leverage.

Market Overview

After you register on MEXC and successfully purchase USDT or tokens, you can start trading derivatives such as futures and margin to gain higher income. ICO Drops is an independent ICO (Token Sale) database and is not affiliated with any ICO project or company. Our Interest Level does not constitute financial or investment advice. Among all the assets available on CoinStats, these have the most similar market capitalization to Equilibrium Exchange. 7,914 people are following the Equilibrium Twitter account @equilibrium_edx, which is 0.28% more than 30 days ago.

To check Equilibrium Games’s price live in the fiat currency of your choice, you can use Crypto.com’s converter feature in the top-right corner of this page.

Meet the most comprehensive DeFi product line

Complete cryptocurrency market coverage with live coin prices, charts and crypto market cap featuring coins on 658 exchanges. It has a circulating supply of 10,000,000,000,000 EQ coins and a total supply of 10,000,000,000,000 EQ. If you are looking to buy or sell EQ, PancakeSwap (v2) is currently the most active exchange. It depends on your personal risk tolerance and investment goals. Equilibrium is a cryptocurrency that is highly volatile and therefore may not be suitable for all investors.

- After you register on MEXC and successfully purchase USDT or tokens, you can start trading derivatives such as futures and margin to gain higher income.

- Past performance is not a reliable indicator of future performance.

- Complete cryptocurrency market coverage with live coin prices, charts and crypto market cap featuring coins on 658 exchanges.

- If you’re looking for a set of practical and insightful crypto market information and data, we have the analytics tools to suit your business needs.

- No part of the content we provide constitutes financial advice on coin prices, legal advice, or any other form of advice meant for you to rely on for any purpose.

- Trading volume of Equilibrium in the last 24h was $14.0293, which is approximately 0.10% of its current market cap.

You can easily purchase tokens on MEXC by just following our simple guides via this link. Equilibrium is a software service with a consensus based governance system. EQ, EQD, and GENS are not a security or regulated instruments. The use of this site and the Equilibrium-based products is subject to Terms of use, by accessing this site you agree to these Terms. If you are new to crypto, use the Crypto.com University and our Help Center to learn how to start buying Bitcoin, Ethereum, and other cryptocurrencies. Explore altcoins commonly held by Equilibrium Exchange investors and discover new opportunities.

Trading Tools

The Equilibrium Games price page is just one in Crypto.com Price Index that features price history, price ticker, market cap, and live charts for the top cryptocurrencies. CryptoRank provides crowdsourced and professionally curated research, price analysis, and crypto market-moving news to help market players make more informed trading decisions. If you’re looking for a set of practical and insightful crypto market information and data, we have the analytics tools to suit your business needs.

Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. For more information, please refer to our Terms of Use and Risk Warning. Please also note that data relating to the above-mentioned cryptocurrency presented here (such as its current live price) are based on third party sources.

![]()

Reached its highest price on when it was trading at its all-time high of , while lowest price was recorded on when it was trading at its all-time low of . The highest price since the last cycle low was (cycle high). ICO Drops receives a fee for advertising certain token sales, in which case such listing will be designated accordingly. Equilibrium has 4,819 members on the @equilibriumportal Telegram channel, which is 6.08% less than 30 days ago. You will find step-by-step guides on how to successfully execute futures trades.

Equilibrium Games Price Chart (USD)

Equilibrium Games’s price today is US$0.03172, with a 24-hour trading volume of $153,210. EQ is +0.00% in the last 24 hours.EQ has a max supply of 98.27 M EQ. Price today is with a 24-hour trading volume of , market cap of , and market dominance of .

Bitcoin price outlook: BlackRock ETF demand could fuel rally to $180,000 – Markets Insider

Bitcoin price outlook: BlackRock ETF demand could fuel rally to $180,000.

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

Trading volume of Equilibrium (EQ) in the last 24h was $N/A, which is approximately 0.00% of its current market cap. Equilibrium is a decentralized financial payment network that rebuilds the traditional payment stack on the blockchain. It utilizes a basket of fiat-pegged stablecoins, algorithmically stabilized by its reserve currency EQ, to facilitate programmable payments and open financial infrastructure development. As of December 2020, the network has transacted an estimated $299 billion for over 2 million users. No part of the content we provide constitutes financial advice on coin prices, legal advice, or any other form of advice meant for you to rely on for any purpose. Any use or reliance on our content is solely at your own risk and discretion.